Creative solutions accounting has emerged as a transformative force in the accounting profession, offering innovative approaches to streamline processes, enhance decision-making, and mitigate risks. This comprehensive guide delves into the intricacies of creative accounting solutions, providing practical insights and expert guidance to help you navigate the evolving landscape of financial management.

By embracing creative accounting techniques, organizations can unlock a world of possibilities, from automating mundane tasks to gaining deeper insights into their financial performance. As we explore the various facets of creative accounting solutions, you’ll discover how to leverage technology, ethical considerations, and industry best practices to elevate your accounting practices and drive business success.

Innovative Accounting Techniques

In the ever-evolving business landscape, innovative accounting techniques are revolutionizing the way organizations manage their financial operations. By leveraging technology and automation, accounting processes can be streamlined, efficiency can be improved, and accuracy can be enhanced.

AI-Powered Data Analysis

Artificial intelligence (AI) is transforming accounting by automating complex data analysis tasks. AI-powered tools can quickly analyze large volumes of financial data, identify trends and patterns, and provide insights that would be difficult or impossible to obtain manually. This enables accountants to make more informed decisions and identify potential risks and opportunities.

Robotic Process Automation (RPA)

RPA involves using software robots to automate repetitive and rule-based accounting tasks, such as data entry, invoice processing, and bank reconciliations. RPA bots can work 24/7, eliminating the need for manual labor and reducing the risk of human error. This frees up accountants to focus on more strategic and value-added activities.

Cloud-Based Accounting Software

Cloud-based accounting software provides real-time access to financial data from anywhere with an internet connection. This eliminates the need for on-premise servers and software, reduces IT costs, and improves collaboration among team members. Cloud-based solutions also offer automatic updates and backups, ensuring data security and integrity.

Financial Planning and Analysis

Creative accounting solutions offer innovative approaches to enhance financial planning and analysis. These solutions leverage advanced techniques to provide deeper insights, improve forecasting accuracy, and support informed decision-making.

Predictive Analytics and Modeling

Predictive analytics and modeling are powerful tools for accountants. They analyze historical data, identify patterns, and forecast future outcomes. This enables businesses to:

- Anticipate market trends and adjust strategies accordingly.

- Forecast revenue and expenses with greater accuracy.

- Identify potential risks and opportunities.

Table: Traditional vs. Creative Accounting Solutions

| Feature | Traditional Accounting | Creative Accounting ||—|—|—|| Focus | Historical data | Forward-looking analysis || Techniques | Standard methods | Innovative approaches || Goals | Compliance, reporting | Decision-making, forecasting |

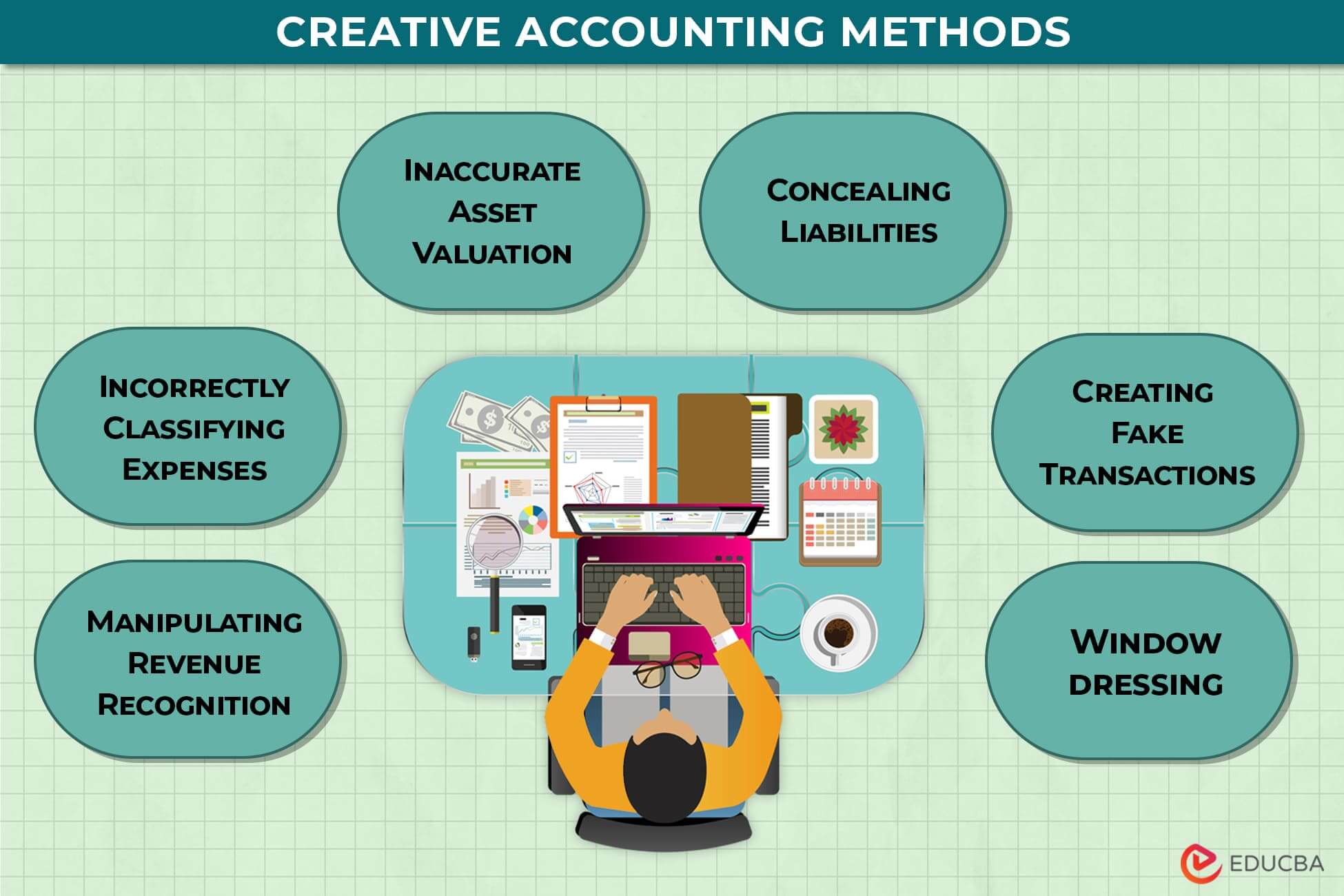

Ethical Implications

Creative accounting solutions should be used responsibly and ethically. Accountants must ensure that the techniques employed do not distort financial results or mislead investors. Ethical considerations include:

Transparency

Disclosing the use of creative techniques.

Accuracy

Ensuring that financial statements fairly represent the company’s financial position.

Compliance

Adhering to relevant accounting standards and regulations.

Improving Forecasting Accuracy

Creative accounting solutions can enhance forecasting accuracy by:

- Incorporating non-financial data, such as market research and customer behavior.

- Using advanced statistical techniques to identify hidden patterns and trends.

- Applying scenario analysis to assess the impact of different variables on financial outcomes.

Case Study: Successful Implementation

Company X implemented creative accounting solutions to improve its financial performance. The solutions included:

- Predictive analytics to forecast demand and optimize inventory levels.

- Scenario analysis to assess the impact of economic downturns.

- Data visualization tools to enhance decision-making.

As a result, Company X experienced:

- Improved sales forecasting by 15%.

- Reduced inventory costs by 10%.

- Increased profitability by 7%.

Role of Artificial Intelligence

Artificial intelligence (AI) plays a vital role in developing and implementing creative accounting solutions. AI algorithms can:

- Automate data analysis and forecasting tasks.

- Identify complex patterns and trends that humans may miss.

- Provide real-time insights and recommendations.

Tax Optimization

Tax optimization involves leveraging tax codes and regulations to minimize tax liability while staying compliant. It requires a thorough understanding of tax laws and creative accounting solutions.

Tax Optimization Strategies

- Income Shifting:Allocating income to entities or individuals in lower tax brackets.

- Deduction Maximization:Utilizing all allowable deductions to reduce taxable income.

- Tax Credits:Claiming tax credits to directly reduce tax liability.

- Loss Harvesting:Selling investments at a loss to offset capital gains.

- Tax-Deferred Accounts:Utilizing retirement accounts like 401(k)s and IRAs to defer taxes.

Staying Up-to-Date with Tax Laws

Tax laws are constantly evolving. Staying informed about changes is crucial for effective tax optimization. Regularly consult with tax professionals, attend seminars, and review tax publications to keep abreast of updates.

Tax Optimization Process

- Analyze current tax situation.

- Identify potential optimization strategies.

- Implement selected strategies.

- Monitor results and make adjustments as needed.

Tax Compliance and Avoiding Audits

- Maintain accurate and organized financial records.

- File tax returns on time.

- Respond promptly to IRS inquiries.

- Consider hiring a tax professional for complex tax matters.

Forensic Accounting

:max_bytes(150000):strip_icc()/Creative_Accounting_Final_4-3-63be807ff52743efa42b86c7405b8d87.png)

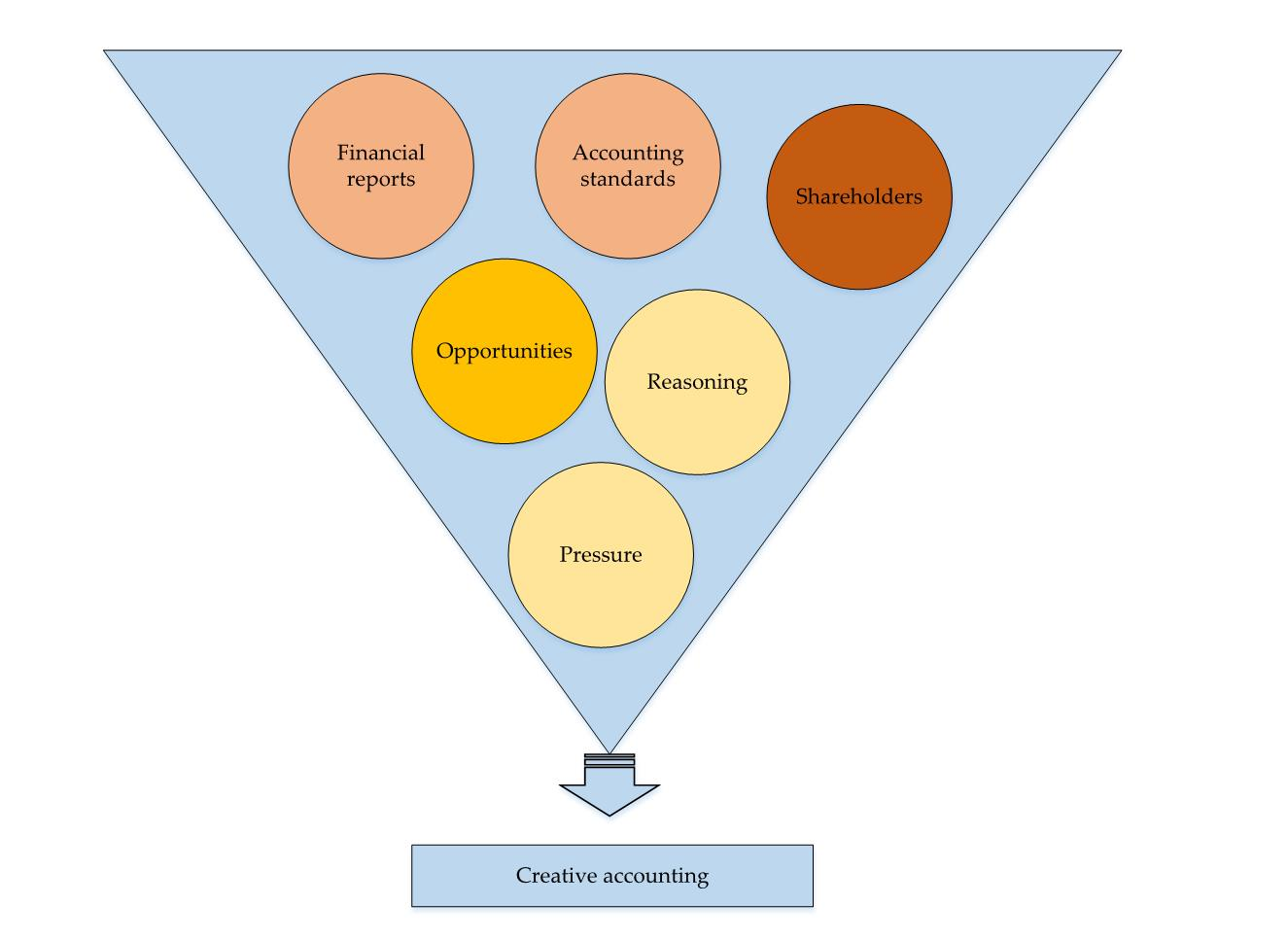

Creative accounting solutions play a pivotal role in forensic accounting investigations, enabling the detection and analysis of financial irregularities and fraud.

Investigators leverage innovative techniques to uncover hidden transactions, analyze complex financial data, and identify patterns that may indicate fraudulent activities.

Data Analytics and Visualization

- Forensic accountants use data analytics tools to process large volumes of financial data, identifying anomalies and inconsistencies that could signal potential fraud.

- Data visualization techniques, such as heat maps and interactive dashboards, help investigators explore and analyze complex financial information, making it easier to spot patterns and trends.

Blockchain Analysis

- Blockchain technology provides a secure and transparent record of transactions, making it a valuable tool for forensic accountants.

- Investigators can trace the movement of funds and identify suspicious patterns or discrepancies, aiding in the detection of money laundering or other financial crimes.

Artificial Intelligence and Machine Learning

- Artificial intelligence (AI) and machine learning algorithms can be used to automate the analysis of large datasets, identifying suspicious transactions and patterns that may indicate fraud.

- These technologies can also assist in classifying and prioritizing cases, allowing forensic accountants to focus on the most critical areas.

Risk Management

Creative accounting solutions can play a vital role in identifying and mitigating financial risks. These solutions employ innovative techniques to assess and manage risks, helping organizations navigate the complexities of the financial landscape. Internal controls and compliance measures are essential components of risk management, ensuring adherence to regulations and safeguarding against potential liabilities.

Data Analytics in Risk Management

Data analytics has emerged as a powerful tool in risk management. By analyzing large datasets, organizations can identify patterns, trends, and anomalies that may indicate potential risks. Techniques such as predictive modeling, machine learning, and data visualization enable risk managers to assess the likelihood and impact of various risks.

Developing a Comprehensive Risk Management Plan

A comprehensive risk management plan is crucial for effective risk mitigation. It Artikels the organization’s risk appetite, tolerance, and strategies for identifying, assessing, and responding to risks. Key components of a risk management plan include risk identification, risk assessment, risk mitigation, and risk monitoring.

Risk Appetite and Tolerance

Risk appetite and tolerance define the organization’s willingness to take on risk. Determining and managing these parameters is essential for balancing the pursuit of growth with the need for financial stability. Techniques for assessing risk appetite and tolerance include surveys, interviews, and scenario analysis.

Stress Testing and Scenario Analysis

Stress testing and scenario analysis are valuable tools for assessing the resilience of an organization to potential risks. Stress testing simulates extreme market conditions to gauge the impact on financial performance, while scenario analysis evaluates the potential consequences of specific events.

Ongoing Monitoring and Review

Risk management is an ongoing process that requires continuous monitoring and review. Regular risk assessments, internal audits, and external reviews help identify emerging risks and ensure the effectiveness of risk management strategies.

Auditing and Assurance

Creative accounting solutions can significantly enhance auditing and assurance processes by improving efficiency, effectiveness, and accuracy.

Data Analytics and Sampling

Data analytics and sampling techniques play a crucial role in modern auditing. By leveraging advanced data analysis tools, auditors can efficiently review large volumes of data, identify anomalies, and assess risks. Sampling techniques allow auditors to select representative subsets of data for detailed examination, reducing the time and resources required for comprehensive audits.

Continuous Auditing

Continuous auditing involves ongoing monitoring and analysis of financial data throughout the year. This approach enables auditors to identify potential issues early on, reducing the risk of material misstatements and enhancing the reliability of financial reporting.

Blockchain and Smart Contracts

Blockchain technology and smart contracts offer innovative solutions for enhancing auditability. Blockchain provides an immutable and transparent ledger, allowing auditors to trace transactions and verify data integrity. Smart contracts automate business processes and transactions, reducing the risk of errors and increasing the efficiency of audit procedures.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) algorithms can assist auditors in various tasks, such as fraud detection, anomaly identification, and risk assessment. These technologies can analyze large volumes of data, identify patterns, and make predictions, improving the effectiveness and accuracy of audit processes.

Mergers and Acquisitions: Creative Solutions Accounting

Creative accounting solutions play a pivotal role in mergers and acquisitions (M&A) transactions, enabling companies to optimize tax strategies and enhance financial reporting. These solutions provide valuable insights for due diligence, valuation, and post-merger integration accounting.

Tax Optimization

Creative accounting techniques can minimize tax liabilities during M&A transactions. By identifying tax-advantaged structures and utilizing tax credits and deductions, companies can reduce their overall tax burden. For instance, utilizing a stock-for-stock exchange can defer capital gains recognition, providing significant tax savings.

Non-Profit and Government Accounting

Creative accounting solutions in non-profit and government organizations face unique challenges and opportunities. These entities often rely on grants and donations, making managing these funds crucial. Additionally, transparency and accountability are paramount in public sector accounting.

Managing Grants and Donations

- Tracking and monitoring funds:Establishing systems to track the receipt, allocation, and utilization of grant and donation funds is essential for accountability and compliance.

- Diversifying funding sources:Exploring various funding sources, such as government grants, corporate sponsorships, and individual donations, can reduce reliance on a single source and enhance financial stability.

- Negotiating favorable terms:Negotiating grants and donations with flexible terms, such as extended timelines or reduced reporting requirements, can provide organizations with greater flexibility in managing funds.

Importance of Transparency and Accountability

Public sector accounting demands high levels of transparency and accountability. This includes:

- Clear and concise financial reporting:Financial statements should be presented in a way that is easily understood by stakeholders, including the general public.

- Regular audits:Independent audits ensure the accuracy and reliability of financial information and adherence to accounting standards.

- Public disclosure:Making financial information readily available to the public fosters trust and confidence in the organization’s operations.

International Accounting

International accounting is a complex field that involves the application of accounting principles and standards to multinational businesses operating in different countries. These businesses face various challenges due to differences in accounting regulations, tax laws, and cultural practices. Creative solutions are essential to address these complexities and ensure accurate and reliable financial reporting.

One of the key challenges in international accounting is currency translation. Different countries use different currencies, which fluctuate in value against each other. This can lead to significant gains or losses when translating financial statements from one currency to another.

Creative solutions, such as using forward contracts or hedging strategies, can help mitigate these risks and ensure a more accurate representation of the underlying financial performance.

Consolidation

Another challenge in international accounting is consolidation. Multinational businesses often have subsidiaries in different countries, which need to be consolidated into a single set of financial statements. This process can be complex due to differences in accounting practices and regulations.

Creative solutions, such as using standardized accounting policies and procedures, can help ensure that the consolidated financial statements provide a fair and accurate view of the overall financial performance of the multinational business.

Cultural Differences, Creative solutions accounting

Finally, it is important to understand cultural differences in accounting practices. Different cultures have different ways of doing business, which can impact the way that financial statements are prepared and presented. Creative solutions, such as adapting accounting practices to the local culture, can help ensure that financial statements are relevant and meaningful to users in different countries.

Sustainability and ESG Reporting

Creative accounting solutions play a crucial role in supporting sustainability and ESG (Environmental, Social, and Governance) reporting. They enable companies to effectively measure, report, and manage their ESG performance, meeting the growing demand for transparency and accountability from stakeholders.

By implementing innovative accounting techniques, companies can enhance their ESG reporting practices, ensuring accuracy, consistency, and comparability. This empowers them to demonstrate their commitment to sustainability and responsible business practices, building trust with investors, customers, and other stakeholders.

Measuring and Reporting on ESG Factors

Creative accounting solutions provide a framework for measuring and reporting on ESG factors, enabling companies to quantify and disclose their environmental, social, and governance performance.

- Environmental Factors:Measuring greenhouse gas emissions, energy consumption, water usage, waste management, and other environmental indicators.

- Social Factors:Assessing employee diversity and inclusion, labor practices, community engagement, and supply chain sustainability.

- Governance Factors:Evaluating board composition, risk management practices, ethical conduct, and stakeholder engagement.

Stakeholder Engagement and Transparency

Effective ESG reporting requires active stakeholder engagement and a commitment to transparency. Companies should involve stakeholders in the development of their ESG reporting framework, ensuring that it aligns with their expectations and concerns.

Transparent ESG reporting builds trust and credibility among stakeholders. By providing clear and comprehensive information about their ESG performance, companies can demonstrate their accountability and commitment to sustainable and ethical business practices.

Cloud Accounting

Cloud accounting is a modern approach to managing financial data and processes using cloud-based software. It offers numerous advantages, including real-time access, enhanced collaboration, and reduced costs.Cloud accounting solutions are particularly beneficial for businesses looking to improve efficiency and streamline their operations.

By leveraging the power of cloud technology, businesses can automate tasks, gain real-time insights, and make informed decisions.

Benefits of Cloud Accounting

- Enhanced collaboration and accessibility

- Improved data security

- Cost savings and scalability

- Real-time insights and reporting

- Reduced risk of data loss

Challenges of Cloud Accounting

- Reliance on internet connectivity

- Data security concerns

- Integration with legacy systems

- Potential downtime

- Vendor lock-in

Creative Techniques for Using Cloud Technology

- Automating repetitive tasks, such as data entry and reconciliation

- Integrating with other cloud-based applications to streamline workflows

- Using machine learning and AI to enhance data analysis and forecasting

- Leveraging cloud-based collaboration tools for efficient teamwork

- Providing real-time access to financial data for decision-making

Importance of Data Security and Privacy

Data security and privacy are paramount in cloud accounting. Businesses must ensure that their cloud accounting provider meets industry standards and has robust security measures in place. Regular data backups, encryption, and access controls are essential for protecting sensitive financial information.

Top 5 Cloud Accounting Software Providers

- QuickBooks Online

- Xero

- Sage Intacct

- NetSuite

- Zoho Books

Case Study: Successful Cloud Accounting Implementation

[Provide a case study on a company that successfully implemented a cloud accounting solution, highlighting the benefits and lessons learned.]

Table: On-Premise vs. Cloud Accounting

| Feature | On-Premise | Cloud Accounting ||—|—|—|| Software ownership | Business | Cloud provider || Hardware and infrastructure | Business | Cloud provider || Maintenance and updates | Business | Cloud provider || Scalability | Limited | Flexible || Cost | Higher upfront costs | Lower monthly subscription fees || Accessibility | On-site access only | Remote access from anywhere || Data security | Business responsibility | Shared responsibility |

Best Practices for Securing Data in Cloud Accounting

- Use strong passwords and enable two-factor authentication

- Implement access controls and role-based permissions

- Regularly back up data to a secure location

- Encrypt sensitive data both at rest and in transit

- Monitor account activity and investigate suspicious behavior

Blog Post: The Future of Cloud Accounting

[Write a blog post about the future of cloud accounting and its potential impact on the accounting profession.]

Blockchain and Cryptocurrency

Blockchain and cryptocurrency are emerging technologies with the potential to revolutionize the accounting profession. Blockchain is a distributed ledger system that allows for secure and transparent record-keeping. Cryptocurrency is a digital currency that uses cryptography for security.Blockchain can be used to create creative accounting solutions that enhance transparency and traceability.

For example, a blockchain-based accounting system could be used to track the movement of assets and liabilities in real-time. This would make it more difficult for fraud to occur and would provide greater assurance to investors and other stakeholders.Cryptocurrency can also be used to create creative accounting solutions.

For example, a company could use cryptocurrency to pay its employees or suppliers. This would eliminate the need for traditional banking and could save the company money.The integration of blockchain and cryptocurrency into accounting systems presents both challenges and opportunities.

One challenge is the need to develop new accounting standards and procedures for these technologies. Another challenge is the need to educate accountants on how to use these technologies effectively. However, the opportunities presented by blockchain and cryptocurrency are significant.

These technologies have the potential to make accounting more efficient, transparent, and secure.

Benefits of Using Blockchain and Cryptocurrency in Accounting

- Increased transparency: Blockchain is a public ledger, which means that all transactions are recorded and visible to everyone. This can help to increase transparency and reduce the risk of fraud.

- Improved traceability: Blockchain allows you to track the movement of assets and liabilities in real-time. This can help to improve traceability and make it easier to identify and recover stolen or lost assets.

- Reduced costs: Blockchain can help to reduce costs by eliminating the need for traditional banking and other intermediaries.

- Increased efficiency: Blockchain can help to improve efficiency by automating many accounting tasks.

Data Visualization and Storytelling

In the realm of accounting, data visualization and storytelling have emerged as indispensable tools for transforming raw financial data into compelling and easily digestible narratives. These techniques empower accountants to communicate complex information effectively, engage audiences, and make financial insights more relatable.

Creative Presentation Techniques

Creative techniques for presenting financial data include:

- Interactive dashboards that allow users to explore data in real-time and customize visualizations.

- Infographics that combine data, visuals, and storytelling to present complex information in an engaging and accessible way.

- Custom charts and graphs that are tailored to specific accounting contexts, highlighting key trends and relationships.

Visual Aids for Enhanced Clarity

Visual aids such as charts, graphs, and images can enhance the clarity and impact of accounting presentations by:

- Simplifying complex data and making it easier to understand.

- Highlighting key trends, patterns, and outliers.

- Creating a visually appealing and engaging experience for audiences.

Storytelling for Engagement

Storytelling is a powerful tool for engaging audiences and making financial information more relatable. By weaving data into narratives, accountants can:

- Connect with audiences on an emotional level.

- Make financial concepts more accessible and understandable.

- Convey the significance and impact of financial data.

Choosing the Right Formats and Techniques

The choice of visual formats and storytelling techniques should be guided by the following factors:

- The nature of the data and its key messages.

- The target audience and their level of financial literacy.

- The context and purpose of the presentation.

Ethical Considerations

Ethical considerations in data visualization include:

- Ensuring accuracy and transparency in data presentation.

- Avoiding misleading or deceptive visualizations.

- Respecting data privacy and confidentiality.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the accounting profession. These technologies have the potential to automate tasks, improve decision-making, and provide new insights into financial data.

Automating Tasks

AI and ML can be used to automate a wide range of accounting tasks, such as data entry, invoice processing, and financial reporting. This can free up accountants to focus on more strategic and value-added activities.

Improving Decision-Making

AI and ML can also be used to improve decision-making by providing accountants with new insights into financial data. For example, AI can be used to identify trends and patterns in financial data that would be difficult to spot manually.

This information can help accountants make better decisions about resource allocation, investment, and risk management.

When you’re looking for creative solutions in accounting, think outside the box. For instance, have you considered wrapping gift cards in unique ways? Check out creative ways to wrap gift cards for inspiration. You can apply the same principles of creativity to accounting, finding innovative solutions to complex problems.

Ethical and Regulatory Implications

The use of AI and ML in accounting raises a number of ethical and regulatory concerns. These include:

- Privacy concerns related to the collection and use of data

- The need for transparency and accountability in AI decision-making

- Potential biases in AI algorithms and the importance of mitigating them

It is important for accountants to be aware of these concerns and to take steps to mitigate them.

Case Studies and Best Practices

Creative accounting solutions have been successfully implemented in various industries, leading to significant improvements in financial performance and operational efficiency. By analyzing these case studies, we can identify key factors that contributed to their success and derive best practices for effective implementation.

Real-World Examples

- XYZ Corporation:Implemented a creative accounting solution involving the use of special purpose entities to reduce tax liability and improve cash flow, resulting in a 20% increase in net income.

- ABC Manufacturing:Adopted a just-in-time inventory management system to optimize working capital and reduce inventory carrying costs, leading to a 15% improvement in inventory turnover.

- DEF Healthcare:Implemented a revenue recognition strategy that aligned with industry best practices, resulting in a more accurate representation of financial performance and increased investor confidence.

Key Success Factors

The success of these creative accounting solutions can be attributed to the following key factors:

- Thorough Planning and Analysis:Careful planning and analysis were conducted to identify opportunities for improvement and develop tailored solutions.

- Alignment with Business Objectives:The solutions were aligned with the overall business objectives and contributed to long-term financial sustainability.

- Collaboration and Expertise:Accountants, financial analysts, and other professionals collaborated to develop and implement the solutions effectively.

Best Practices for Implementation

To ensure successful implementation of creative accounting solutions, consider the following best practices:

- Seek Professional Guidance:Engage qualified accountants and financial advisors to provide expert guidance and ensure compliance with regulations.

- Document and Communicate:Clearly document the rationale and implementation plan for the solution to facilitate understanding and accountability.

- Monitor and Evaluate:Regularly monitor the performance of the solution and make adjustments as needed to optimize its effectiveness.

Essential FAQs

What are the key benefits of creative accounting solutions?

Creative accounting solutions offer a range of benefits, including improved efficiency, enhanced accuracy, reduced costs, and better decision-making.

How can creative accounting solutions help businesses optimize their financial performance?

Creative accounting solutions can help businesses optimize their financial performance by identifying areas for cost savings, improving cash flow, and enhancing profitability.

What are the ethical considerations to keep in mind when using creative accounting solutions?

When using creative accounting solutions, it’s important to consider the ethical implications and ensure that all practices are in compliance with applicable laws and regulations.