In the realm of real estate, the art of creative investing shines as a beacon of innovation. This captivating guide delves into unconventional strategies that transcend traditional rental models, empowering investors to unlock hidden value and optimize their portfolios. From crowd-funding and lease options to cutting-edge financing techniques, we explore the vast landscape of creative real estate investing, providing a roadmap for maximizing returns and mitigating risks.

As we navigate the ever-evolving real estate market, this comprehensive resource equips investors with the knowledge and tools to stay ahead of the curve. By embracing creative approaches, we unlock a world of possibilities, where savvy investors can uncover hidden gems, transform undervalued properties, and capitalize on emerging trends.

Creative Real Estate Investing Strategies

Traditional rental properties are just the tip of the iceberg when it comes to real estate investing. Creative strategies can unlock new opportunities, maximize returns, and mitigate risks.

Innovative approaches include:

Crowd-funding, Creative real estate investing

- Pooling funds from multiple investors to acquire properties.

- Provides access to larger deals and diversification.

Lease Options

- Giving tenants the option to purchase a property after a lease period.

- Generates rental income while building equity for potential future sale.

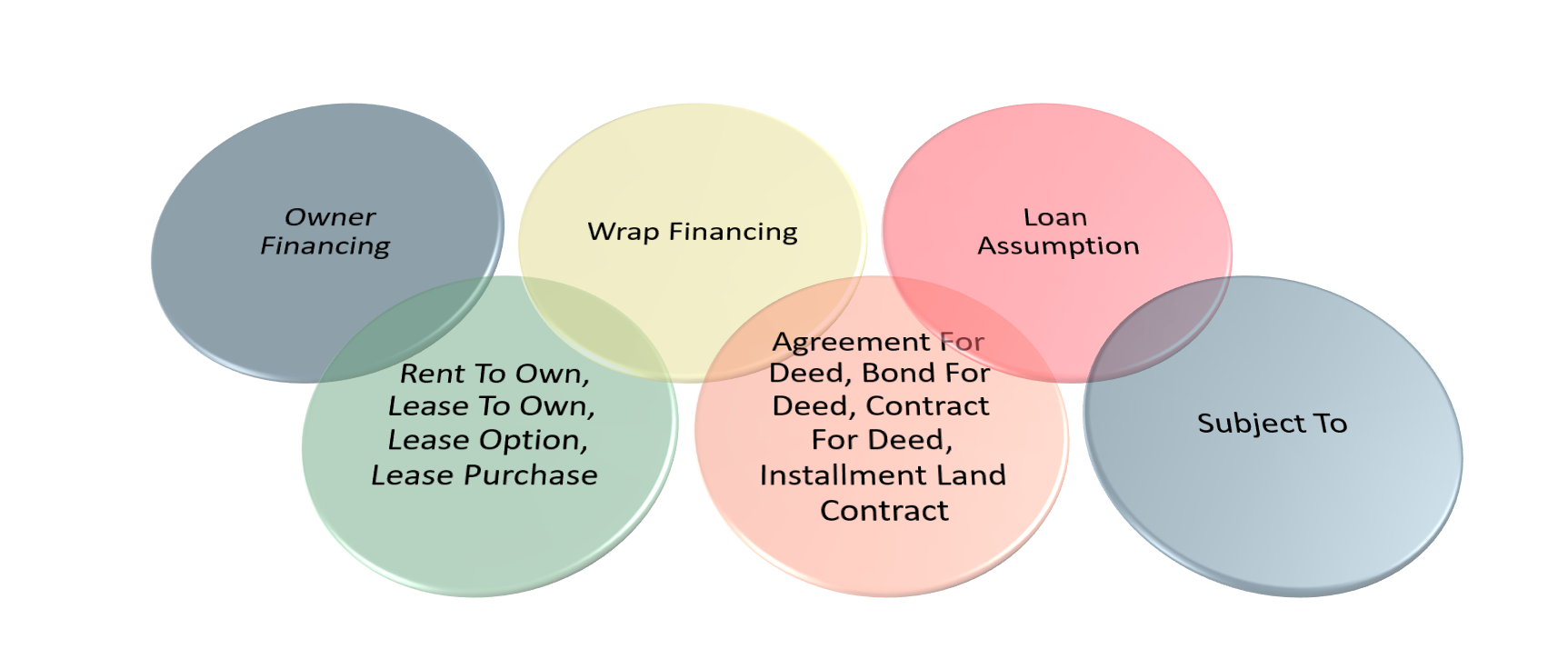

Creative Financing

- Using non-traditional financing methods, such as seller financing or lease-to-own.

- Expands investment options and reduces upfront costs.

Identifying Hidden Value in Real Estate

Unveiling the hidden potential in real estate investments requires a keen eye and a strategic approach. Investors can uncover undervalued properties with high growth prospects by analyzing market data, assessing property conditions, and understanding neighborhood trends.

Techniques for Uncovering Undervalued Properties

Market Analysis

Study local market trends, including sales prices, rental rates, and vacancy rates, to identify areas with potential for growth.

Property Inspections

Conduct thorough property inspections to assess the condition of the building, identify potential repairs, and estimate renovation costs.

Neighborhood Research

Evaluate the neighborhood’s demographics, crime rates, schools, and amenities to gauge its desirability and future prospects.

Types of Undervalued Properties

Distressed Assets

Properties facing foreclosure or other financial distress, often available at below-market prices.

Foreclosures

Properties that have been repossessed by the lender and can be purchased through an auction or private sale.

If you’re into creative real estate investing, you might want to check out fortnite creative hq. It’s a platform that connects investors with creative professionals who can help them find and develop unique real estate projects. Whether you’re looking to invest in a new development or renovate an existing property, fortnite creative hq can help you get started.

Off-Market Properties

Properties not actively listed for sale, which may be available for purchase directly from the owner.

Negotiating with Sellers

Due Diligence

Conduct thorough due diligence, including property inspections and title searches, before making an offer.

Comparative Market Analysis (CMA)

Determine the property’s fair market value by comparing it to similar properties in the area.

Negotiation Skills

Develop strong negotiation skills to secure the best possible deal, including concessions on price or repairs.

Repositioning and Renovating Properties

Renovating and repositioning properties can revitalize aging or underperforming assets, unlocking their hidden value and enhancing their profitability. This involves transforming the property’s use, design, or amenities to meet changing market demands and increase its appeal to potential buyers or tenants.

Planning and Execution

Planning and executing successful renovations require careful consideration of project scope, budget, design, and construction management. Start by defining the project goals and conducting thorough market research to assess demand and competition. Create a detailed project plan outlining the renovation steps, timelines, and costs.

Engage experienced contractors and designers to ensure quality workmanship and adherence to building codes.

Transforming Properties

Creative renovations can dramatically transform properties, improving their functionality, aesthetics, and overall value. Consider adding amenities, reconfiguring floor plans, or updating finishes to enhance the property’s appeal. Showcase before-and-after photos, floor plans, and case studies to demonstrate the transformative power of renovation.

Key Steps

- Assessment:Evaluate the property’s condition, market demand, and potential for repositioning or renovation.

- Planning:Define project goals, conduct market research, and create a detailed project plan.

- Design:Engage designers to create functional and aesthetically pleasing designs that meet market demand.

- Construction:Hire experienced contractors to execute the renovations efficiently and within budget.

- Marketing:Develop a marketing strategy to showcase the renovated property’s value and attract potential buyers or tenants.

Case Study

A historic warehouse was successfully repositioned into a modern office space. The renovation included preserving the building’s original character while adding modern amenities and updating the floor plan to create flexible workspaces. The project resulted in a 20% increase in rental income and attracted high-profile tenants.

Glossary

- Repositioning:Changing the use or target market of a property to enhance its value.

- Renovation:Upgrading or repairing a property to improve its condition or functionality.

- Floor Plan:A diagram showing the layout of rooms and spaces within a property.

- Building Codes:Regulations governing the construction and safety of buildings.

Checklist

Before considering repositioning or renovating a property, ask yourself:

- What are the current market trends and demand for the property type?

- Is the property in a desirable location and has potential for appreciation?

- What is the estimated cost of the renovation and its potential return on investment?

- Are there any regulatory hurdles or zoning restrictions that may impact the project?

- Do I have the expertise and resources to manage the renovation process effectively?

Provide examples of successful niche real estate investments.

Investing in niche real estate markets can yield substantial returns for savvy investors. Here are a few examples of successful niche investments:

- Vacation rentals:Short-term rentals have become increasingly popular due to platforms like Airbnb and Vrbo. Investors who purchase properties in popular tourist destinations can generate significant income from vacationers.

- Student housing:With the rising cost of college tuition, student housing is in high demand. Investors who invest in properties near universities or colleges can benefit from long-term, stable rental income.

- Senior living:The aging population has created a growing need for senior housing. Investors who specialize in this niche can cater to the specific needs of older adults and generate steady returns.

Legal and Tax Considerations

Understanding the legal and tax implications of creative real estate investing is crucial for success.Navigating legal requirements and avoiding pitfalls ensures compliance and maximizes financial benefits.

Tax Benefits

Creative real estate investing offers significant tax advantages, including:

- Depreciation: Deducting a portion of the property’s value over its useful life, reducing taxable income.

- 1031 Exchanges: Exchanging one investment property for another of equal or greater value without triggering capital gains tax.

Technology in Creative Real Estate Investing

Technology has emerged as a game-changer in creative real estate investing, empowering investors to identify, acquire, and manage properties with greater efficiency and profitability.

Virtual tours allow investors to view properties remotely, saving time and travel expenses. Property management software streamlines tasks such as rent collection, maintenance requests, and tenant communication. Data analytics tools provide insights into market trends, property performance, and potential investment opportunities.

Virtual Tours

- Enable remote property viewings, reducing travel costs and time.

- Provide immersive experiences, allowing investors to explore properties in detail.

- Increase accessibility, especially for investors located far from the property.

Property Management Software

- Automate rent collection and accounting, reducing manual errors and saving time.

- Manage maintenance requests, track expenses, and communicate with tenants.

- Provide online portals for tenants to access property information and submit requests.

Data Analytics Tools

- Analyze market trends, identify potential investment areas, and assess property performance.

- Predict rental rates, property values, and market demand.

- Identify undervalued properties and make informed investment decisions.

Case Studies

- Investor X used virtual tours to screen properties remotely, saving over $5,000 in travel expenses.

- Investor Y implemented property management software, reducing tenant turnover by 15% and increasing rental income by 3%.

- Investor Z leveraged data analytics to identify an undervalued property, which they acquired at a 20% discount and later sold for a 50% profit.

Ethical Considerations: Creative Real Estate Investing

Creative real estate investing offers opportunities for financial gain, but it’s crucial to consider the ethical implications. Gentrification, displacement, and environmental impact are concerns that arise in this context.

Responsible Investing Guidelines

To invest responsibly, align your practices with community values. Engage with local residents, understand their needs, and seek investments that contribute to the neighborhood’s well-being. Prioritize projects that enhance community spaces, preserve historical landmarks, or provide affordable housing options.

Gentrification and Displacement

Gentrification, a process of urban renewal that often leads to increased property values and displacement of low-income residents, raises ethical concerns. Consider the impact of your investments on the existing community. Avoid practices that accelerate displacement or exacerbate social inequality.

Environmental Impact

Real estate development has significant environmental implications. Evaluate the environmental impact of your projects. Prioritize sustainable practices, such as energy efficiency, water conservation, and responsible waste management. Seek opportunities to restore degraded land or incorporate green spaces into your developments.

Case Studies of Successful Creative Real Estate Investors

Learning from the experiences of successful creative real estate investors is invaluable. Their stories offer insights into effective strategies, tactics, and the mindset required to achieve significant returns.

By examining case studies, we can gain a deeper understanding of the challenges and triumphs faced by these investors, and glean valuable lessons to apply to our own investments.

Case Study: House Hacking

John, a young professional, purchased a multi-family property and lived in one unit while renting out the others. This “house hacking” strategy allowed him to cover his mortgage payments and build equity while living rent-free.

John’s due diligence in researching the local market and securing a property with strong rental potential was crucial to his success. He also meticulously managed his finances to ensure the rental income exceeded his expenses.

Case Study: BRRRR Method

Mary, a seasoned investor, used the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) method to acquire and renovate distressed properties.

Mary’s strategy involved purchasing properties below market value, renovating them to increase their value, renting them out to generate cash flow, and then refinancing to extract equity and repeat the process.

Mary’s success was attributed to her ability to identify undervalued properties, negotiate favorable purchase prices, and manage renovation projects efficiently.

Case Study: Fix-and-Flip

Bob, a contractor, specialized in purchasing distressed properties, renovating them, and selling them for a profit. His fix-and-flip strategy required a deep understanding of construction and market trends.

Bob’s due diligence included thorough property inspections and accurate cost estimates. He also leveraged his contractor skills to minimize renovation expenses and maximize the property’s value.

Common Traits of Successful Creative Real Estate Investors

- Strong market research and due diligence

- Ability to identify undervalued properties

- Skilled negotiation and financial management

- Persistence and adaptability

- Understanding of construction and renovation

“Success in creative real estate investing requires a combination of market knowledge, financial acumen, and a willingness to embrace innovative strategies.”- Mary, BRRRR investor

Common Pitfalls and How to Avoid Them

Creative real estate investing, while potentially lucrative, also carries risks. It’s crucial to be aware of common pitfalls and develop strategies to mitigate them.

Mistakes made by creative real estate investors often stem from inadequate research, overleveraging, poor due diligence, and a lack of experience.

Inadequate Research

- Failing to thoroughly research the market, property, and potential returns can lead to costly errors.

- Not understanding local zoning laws, building codes, and other regulations can result in unexpected delays and expenses.

Overleveraging

- Borrowing too much money can increase financial risk and limit flexibility in the event of unforeseen circumstances.

- Consider carefully the debt-to-income ratio, cash flow, and other financial metrics before taking on excessive debt.

Poor Due Diligence

- Neglecting to conduct thorough inspections and environmental assessments can lead to hidden problems that can drain resources.

- Failing to review legal documents, such as contracts and title reports, can result in unexpected liabilities.

Lack of Experience

- Investing in unfamiliar markets or property types without adequate experience can increase the risk of failure.

- Seek guidance from experienced mentors, attend workshops, and educate yourself before making significant investments.

Examples of Failed Investments

- A novice investor purchased a historic building without considering the extensive renovation costs and strict zoning restrictions, resulting in a significant financial loss.

- An investor overleveraged on a speculative property during a market downturn, leading to foreclosure and a damaged credit score.

Tools and Resources for Creative Real Estate Investors

To succeed in creative real estate investing, leveraging valuable resources is essential. These include websites, books, software, industry associations, conferences, networking opportunities, and online platforms that connect investors with properties and financing.

Staying informed and connected is crucial. Industry associations, such as the National Association of Realtors (NAR) and the Institute for Real Estate Management (IREM), offer educational resources, networking events, and industry updates. Attending conferences and workshops provides opportunities to learn from experts, exchange ideas, and discover new investment strategies.

Online Resources

The internet offers a wealth of information for creative real estate investors. Websites like BiggerPockets, The Real Deal, and Forbes provide articles, forums, and podcasts covering various aspects of the industry.

- BiggerPockets:A large online community with forums, podcasts, and educational resources for real estate investors of all levels.

- The Real Deal:A news and information website covering the commercial real estate industry, providing insights into market trends and investment opportunities.

- Forbes:A business magazine with a dedicated section on real estate, featuring articles on investment strategies, market analysis, and industry news.

Software and Tools

Technology plays a vital role in creative real estate investing. Software and tools can streamline tasks, enhance analysis, and improve decision-making.

- Property Management Software:Manages tenant relationships, rent collection, maintenance requests, and financial reporting.

- Market Analysis Tools:Provides data on market trends, demographics, and property values, helping investors identify potential investment opportunities.

- Financial Calculators:Calculates cash flow, return on investment (ROI), and other financial metrics, assisting investors in evaluating the profitability of potential investments.

Networking and Collaboration

Building relationships and collaborating with other professionals is crucial for success in creative real estate investing. Attending industry events, joining local investor groups, and connecting with real estate agents, lenders, and contractors can provide valuable insights, leads, and support.

Creating a Business Plan for Creative Real Estate Investing

Developing a solid business plan is essential for the success of any creative real estate venture. It provides a roadmap for your investment strategy and helps you stay organized and focused throughout the process.

Key Elements of a Business Plan

A comprehensive business plan should include the following key elements:

Executive Summary

A brief overview of your investment strategy, goals, and expected outcomes.

Market Analysis

A thorough analysis of the local real estate market, including current trends, competition, and potential opportunities.

Investment Strategy

A detailed description of your investment approach, including the types of properties you will target, your acquisition and exit strategies, and your risk tolerance.

Financial Projections

Realistic financial projections that Artikel your expected revenue, expenses, and profit.

Team and Resources

A list of the key team members involved in your venture and the resources you will need to execute your plan.

Benefits of a Business Plan

Creating a business plan offers numerous benefits, including:

Clarity and Focus

It forces you to think through your investment strategy and identify potential risks and opportunities.

Communication

It provides a clear and concise document that you can share with potential investors or partners.

Organization

It helps you stay organized and track your progress throughout the investment process.

Flexibility

It allows you to adapt your strategy as market conditions change or new opportunities arise.

Tips for Writing a Successful Business Plan

Be realistic

Avoid making unrealistic assumptions or projections.

Be specific

Provide detailed information about your investment strategy and financial projections.

Be concise

Keep your business plan clear and concise, avoiding unnecessary jargon or technical terms.

Get feedback

Seek feedback from experienced investors or mentors to improve your plan.

Exit Strategies for Creative Real Estate Investments

Creative real estate investments offer unique opportunities for investors to generate substantial returns. However, it is equally important to consider the exit strategy before committing to any investment. An effective exit strategy can maximize profits, minimize tax liabilities, and ensure a successful outcome.

Various Exit Strategies

Various exit strategies exist for creative real estate investments, each with its own pros and cons:

Selling

Selling the property is the most straightforward exit strategy. It allows investors to realize their profits immediately and move on to other investments. However, selling can also trigger capital gains taxes, which can reduce the net proceeds.

Refinancing

Refinancing involves taking out a new loan against the property to extract equity. This can be a good option if the investor wants to retain ownership of the property while accessing capital for other ventures. However, refinancing can come with additional fees and interest payments.

1031 Exchange

A 1031 exchange allows investors to defer capital gains taxes by exchanging their property for a similar one. This can be a valuable strategy for investors who want to continue investing in real estate without triggering a taxable event. However, 1031 exchanges have strict rules and requirements that must be met.

Private Placement

A private placement involves selling the property to a group of accredited investors. This can be a good option for investors who want to avoid the public market and have more control over the sale process. However, private placements can be time-consuming and may involve higher transaction costs.

Lease Option

A lease option gives a tenant the right to purchase the property at a set price within a specified time frame. This can be a good option for investors who want to generate income from the property while giving the tenant the opportunity to build equity.

However, lease options can be complex and may not be suitable for all investors.

The Future of Creative Real Estate Investing

The future of creative real estate investing is bright, with emerging trends and innovations set to transform the industry. Technology, sustainability, and changing demographics will play a significant role in shaping the landscape, creating new opportunities and challenges for investors.

Technology

Artificial intelligence (AI) and machine learning (ML) are streamlining property management and investment analysis. Proptech startups are revolutionizing the industry with innovative solutions, while fractional ownership and crowdfunding platforms are making real estate investing more accessible.

Sustainability

The demand for sustainable and energy-efficient properties is growing, driven by environmental concerns and government regulations. Virtual reality (VR) and augmented reality (AR) are transforming property marketing and due diligence, allowing investors to explore properties remotely.

Demographics

Aging populations and millennials are having a significant impact on the real estate market. Investors need to understand the specific needs and preferences of these demographics to identify growth areas and niche markets.

Commonly Asked Questions

What are the benefits of creative real estate investing?

Creative real estate investing offers a range of benefits, including increased returns, diversification of portfolios, access to unique opportunities, and the potential to mitigate risks.

What are some examples of creative real estate investing strategies?

Creative real estate investing strategies include crowd-funding, lease options, seller financing, value-add renovations, and niche market investing.

How can I identify undervalued properties?

To identify undervalued properties, consider factors such as market analysis, property condition, neighborhood trends, and comparable sales data.

What are the risks associated with creative real estate investing?

Creative real estate investing involves risks, including market fluctuations, tenant issues, and the potential for financial loss. It’s crucial to conduct thorough due diligence and seek professional advice before making any investment decisions.

How can I get started with creative real estate investing?

To get started with creative real estate investing, educate yourself, network with other investors, explore different strategies, and seek guidance from experienced professionals.