Creative finance has emerged as a game-changer in the financial landscape, offering businesses and individuals access to innovative funding solutions that break away from traditional financing constraints. This article explores the world of creative finance, examining its advantages, applications, and the latest trends shaping its future.

Overview of Creative Finance

Creative finance refers to innovative financial strategies and techniques that go beyond traditional financing methods to meet business objectives. It involves unconventional approaches to raising capital, structuring deals, and managing financial risks.

Examples of creative financing include:

- Leveraged buyouts (LBOs):Using debt to acquire a company.

- Asset-backed securities (ABSs):Pooling and selling financial assets to investors.

- Private equity investments:Investing in private companies that are not publicly traded.

Advantages and Disadvantages of Creative Financing

Advantages:

- Access to capital for businesses that may not qualify for traditional financing.

- Lower cost of capital compared to traditional financing.

- Flexibility in structuring deals to meet specific business needs.

Disadvantages:

- Increased financial risk due to higher levels of debt or unconventional structures.

- Potential for legal and regulatory challenges.

- Complexity and potential for misunderstandings among parties involved.

Benefits of Creative Finance

Creative financing offers a wealth of advantages for businesses seeking financial solutions. It enhances financial flexibility by providing access to funding beyond traditional sources. This flexibility allows businesses to adapt to changing market conditions, seize growth opportunities, and minimize reliance on conventional lending.

Creative financing also fuels growth potential. By unlocking alternative sources of capital, businesses can invest in expansion, research and development, and strategic acquisitions. This investment drives innovation, market share growth, and long-term profitability.

Examples of Successful Companies

- Tesla:Utilized creative financing, such as convertible bonds and stock-based compensation, to fund its early-stage development and accelerate its transition to electric vehicle production.

- Airbnb:Leveraged creative financing options, including venture capital and debt financing, to support its rapid global expansion and establish itself as a dominant player in the hospitality industry.

- Amazon:Employed creative financing strategies, such as convertible debt and stock options, to fuel its ambitious growth plans and transform itself from an online bookseller into a global e-commerce giant.

Applications of Creative Finance

Creative finance finds applications in various industries and sectors. It enables organizations to explore innovative financing solutions that align with their unique requirements and objectives. Let’s delve into some key areas where creative finance is commonly employed:

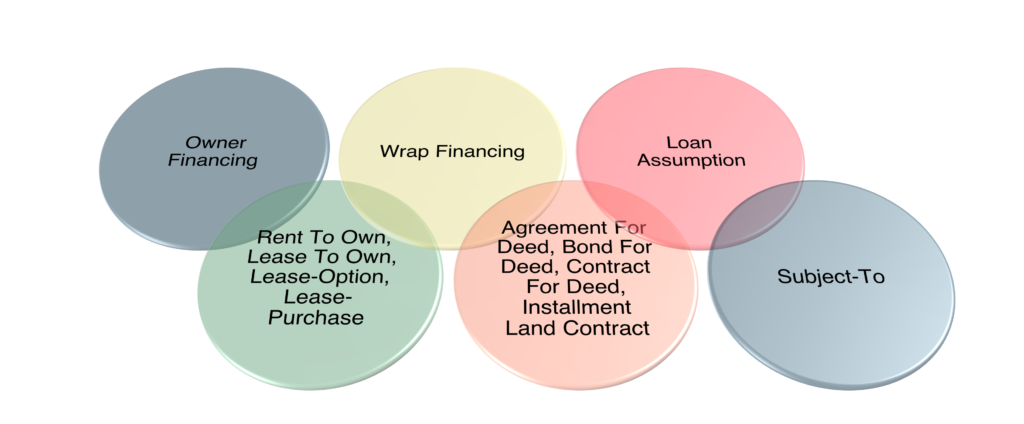

The real estate industry utilizes creative finance to facilitate property acquisition, development, and financing. One example is the use of seller financing, where the seller acts as the lender, allowing buyers to purchase properties with flexible payment terms.

Leveraged Buyouts (LBOs)

LBOs are a type of creative financing technique used in the private equity industry. In an LBO, a private equity firm acquires a target company using a combination of debt and equity financing. The acquired company’s assets are often used as collateral for the debt, which reduces the risk for the private equity firm and allows them to acquire companies with high leverage.

Project Finance

Project finance is a financing structure used for large-scale infrastructure projects. It involves raising capital from a group of lenders and investors who provide financing based on the project’s cash flow projections. Project finance allows developers to access funding for projects that may not have traditional sources of financing, such as government grants or corporate loans.

Structured Finance

Structured finance involves creating complex financial products that combine different types of assets and liabilities. These products are often used by financial institutions to manage risk and generate returns for investors. Structured finance techniques include securitization, collateralized debt obligations (CDOs), and credit-linked notes (CLNs).

Types of Creative Financing Techniques

Creative financing encompasses a diverse array of techniques that enable businesses and individuals to access capital in innovative and flexible ways. These techniques offer solutions to conventional financing limitations and cater to unique project requirements.

Key types of creative financing techniques include asset-backed lending, mezzanine financing, and structured products. Each technique possesses distinct characteristics, advantages, and risks, making them suitable for different scenarios.

Asset-Backed Lending

Asset-backed lending involves borrowing funds against a specific asset or group of assets. The assets serve as collateral, providing lenders with a level of security. This technique is commonly used to finance projects with tangible assets, such as real estate, equipment, or receivables.

- Advantages:Lower interest rates, longer repayment terms, and the ability to leverage assets.

- Risks:Potential for asset devaluation or loss in case of default.

Example:A construction company obtains a loan backed by the completed units of a residential development.

Mezzanine Financing

Mezzanine financing is a hybrid form of debt and equity financing. It typically involves a loan that is subordinated to senior debt, meaning it has a lower priority in the event of a default. Mezzanine loans often come with equity-like features, such as warrants or convertible debt.

- Advantages:Provides additional funding beyond traditional debt, flexible terms, and potential equity upside.

- Risks:Higher interest rates and subordination to senior debt.

Example:A private equity firm provides mezzanine financing to a growth-stage technology company.

Structured Products

Structured products are complex financial instruments that combine different types of underlying assets and risk profiles. They are often tailored to meet specific investment objectives and can provide unique risk-return profiles.

- Advantages:Potential for enhanced returns, diversification, and tailored solutions.

- Risks:Complexity, lack of transparency, and potential for losses.

Example:A structured product that combines bonds and derivatives to create a targeted income stream.

– Discuss the potential risks involved in using creative financing techniques, such as

The utilization of creative financing strategies can potentially introduce certain risks, which must be meticulously assessed and appropriately mitigated. These potential risks include increased complexity and opacity of financial instruments, misalignment of interests among stakeholders, and regulatory uncertainties.

The intricate nature of creative financing instruments can result in heightened complexity and diminished transparency. This can pose challenges in comprehending the underlying risks and making informed decisions. Moreover, the misalignment of interests between different stakeholders can lead to conflicts and potential disputes.

Additionally, the regulatory landscape surrounding creative financing techniques can be uncertain and subject to change. This can introduce compliance challenges and increase the risk of non-compliance with applicable regulations.

Strategies for mitigating risks

To mitigate the potential risks associated with creative financing techniques, it is imperative to adopt a proactive and comprehensive approach. This involves conducting thorough due diligence and stress testing to fully comprehend the risks involved and assess the resilience of the financial instrument under various scenarios.

Furthermore, implementing robust risk management frameworks is crucial. These frameworks should encompass clear policies, procedures, and controls to identify, assess, and manage risks effectively.

Establishing clear communication and reporting channels among stakeholders is also essential. This facilitates the timely exchange of information, promotes transparency, and enables prompt decision-making in response to changing circumstances.

Legal and Regulatory Considerations

Creative financing techniques operate within legal and regulatory frameworks that govern financial transactions. Understanding these frameworks is crucial for compliance and mitigating potential risks.

Non-compliance can result in penalties, legal liabilities, and reputational damage. It is essential to seek legal advice to ensure that creative financing arrangements align with applicable laws and regulations.

Compliance with Laws and Regulations

- Securities laws: Regulate the issuance, sale, and trading of securities, ensuring transparency and investor protection.

- Tax laws: Determine the tax treatment of creative financing arrangements, influencing the overall financial impact.

- Banking regulations: Govern the activities of financial institutions, including lending practices and risk management.

- Anti-money laundering and anti-terrorism financing regulations: Prevent the use of financial transactions for illegal activities.

– Discuss the latest trends and innovations in creative finance, including

The financial landscape is constantly evolving, and creative finance is at the forefront of this evolution. New trends and innovations are emerging that are changing the way businesses and investors approach financing.

Some of the most notable trends in creative finance include:

- Green finance

- Social impact finance

- Blockchain-based finance

- Artificial intelligence-driven finance

Green finance

Green finance is a rapidly growing field that focuses on financing projects that have a positive environmental impact. This can include projects that reduce greenhouse gas emissions, promote renewable energy, or improve water conservation.

Green finance is becoming increasingly popular as investors become more aware of the importance of sustainability. In addition, governments are increasingly offering incentives for businesses to adopt green practices.

Social impact finance

Social impact finance is another growing field that focuses on financing projects that have a positive social impact. This can include projects that provide affordable housing, improve education, or promote economic development.

Social impact finance is becoming increasingly popular as investors seek to make a positive impact on the world while also earning a financial return.

Blockchain-based finance

Blockchain is a distributed ledger technology that is revolutionizing the way financial transactions are processed. Blockchain-based finance is still in its early stages, but it has the potential to disrupt traditional financial markets.

Blockchain-based finance can offer a number of advantages over traditional finance, including increased transparency, security, and efficiency.

Artificial intelligence-driven finance

Artificial intelligence (AI) is being used in a variety of ways to improve financial decision-making. AI-driven finance can help businesses identify and manage risks, optimize their investment portfolios, and provide personalized financial advice.

AI-driven finance is still in its early stages, but it has the potential to transform the way financial services are delivered.

Ethical Considerations in Creative Finance

The use of creative financing techniques raises ethical concerns that must be carefully considered to ensure fair and responsible practices.

Transparency and disclosure are paramount. All parties involved should have a clear understanding of the terms, risks, and potential consequences of the financing arrangement. This includes disclosing any potential conflicts of interest or hidden fees.

Responsible Decision-Making

Responsible decision-making is crucial in creative financing. Lenders and borrowers should carefully evaluate the feasibility and sustainability of the financing arrangement. This includes considering the long-term implications, potential impact on other stakeholders, and the alignment with ethical and legal standards.

Case Studies of Creative Finance Successes

Creative financing techniques have been successfully implemented in various industries, leading to innovative solutions and significant financial benefits. Let’s delve into some notable case studies:

Real Estate Investment Trusts (REITs)

REITs are a popular example of creative financing in real estate. They allow investors to pool their funds to invest in a diversified portfolio of income-generating real estate assets. By doing so, investors gain access to real estate investments with potentially higher returns and lower risks than investing directly in individual properties.REITs have enabled small investors to participate in the real estate market, providing them with access to a broader range of investment options.

They have also allowed real estate companies to raise capital for development projects and acquisitions, facilitating the growth of the industry.

Project Finance

Project finance is a financing structure used to fund large-scale infrastructure and energy projects. It involves raising funds from multiple lenders and investors, each with a specific role and risk allocation. This approach allows projects to access capital without relying solely on traditional bank loans or equity financing.One notable example of project finance success is the financing of the Channel Tunnel project between England and France.

The project was funded through a combination of debt and equity financing from various sources, including banks, pension funds, and insurance companies. The innovative financing structure allowed the project to secure funding despite its high cost and perceived risks.

Private Equity and Venture Capital

Private equity and venture capital are creative financing techniques that provide funding to early-stage and growth-oriented companies. These funds invest in companies that have the potential for high growth and returns, but may not yet be ready for traditional public offerings or bank loans.One successful example of private equity financing is the investment in Airbnb by Sequoia Capital.

Sequoia provided early-stage funding to Airbnb, which enabled the company to expand its operations and become a global leader in the vacation rental industry.

Creative finance involves finding innovative ways to finance projects or businesses. One key aspect of creative finance is assessing the financial health of a company. To do this, you can use a Z-score. If you’re not sure how to calculate a Z-score in Excel, check out this helpful guide: how to calculate z-score in excel.

Understanding how to calculate a Z-score is a valuable skill for anyone involved in creative finance.

Challenges and Limitations of Creative Finance

While creative financing techniques offer flexibility and innovation, they also come with challenges and limitations.

One key challenge is the potential for increased complexity. Creative financing structures can involve multiple parties and complex legal agreements, which can be difficult to manage and understand.

Legal and Regulatory Considerations

Creative financing techniques must comply with applicable laws and regulations. Failure to do so can result in legal penalties or the invalidation of the financing agreement.

Market Volatility

Creative financing techniques can be more sensitive to market fluctuations than traditional financing methods. Changes in interest rates or economic conditions can impact the value of the underlying assets or the terms of the financing agreement.

Suitability

Creative financing techniques may not be suitable for all situations. They can be more expensive or complex than traditional financing methods, and they may not be appropriate for borrowers with poor credit or limited financial resources.

Alternative Approaches

In some cases, alternative approaches to financing may be more appropriate than creative financing techniques. These alternatives include:

- Traditional bank loans

- Government-backed loans

- Venture capital

- Crowdfunding

The choice of financing approach should be based on a careful evaluation of the borrower’s needs, financial situation, and the specific circumstances of the transaction.

– Share best practices for implementing creative financing solutions.: Creative Finance

Creative financing can be a valuable tool for businesses and individuals seeking alternative funding options. To successfully implement creative financing solutions, it’s crucial to follow certain best practices:

Due diligence and risk assessment

Conduct thorough due diligence on all parties involved in the transaction, including the borrower, lender, and any guarantors. This includes reviewing financial statements, credit history, and any relevant legal documents.

Carefully assess the risks associated with the financing solution, including the potential for default, changes in interest rates, and market conditions.

Structuring and negotiating creative financing agreements

Clearly define the terms of the financing agreement, including the loan amount, interest rate, repayment schedule, and any collateral or guarantees.

Negotiate favorable terms that align with the needs and objectives of both the borrower and the lender.

Monitoring and reporting

Establish a system for monitoring the performance of the financing solution, including regular reporting and financial analysis.

Make adjustments as necessary to ensure the financing solution remains viable and meets the ongoing needs of the parties involved.

Role of Technology in Creative Finance

Technology plays a pivotal role in facilitating creative financing techniques, enhancing efficiency, and expanding accessibility.

Data Analytics

Data analytics enables the analysis of vast amounts of financial data, identifying patterns and trends that inform decision-making. It helps underwriters assess risk profiles, optimize loan terms, and uncover hidden opportunities.

Artificial Intelligence

Artificial intelligence (AI) automates tasks, improves accuracy, and provides real-time insights. AI-powered platforms can process loan applications, underwrite transactions, and manage risk, streamlining the creative financing process.

Blockchain, Creative finance

Blockchain technology offers secure and transparent record-keeping, facilitating the tracking and management of complex financial transactions. It enhances transparency, reduces fraud, and enables the creation of innovative financing models.

Future Outlook of Creative Finance

The future of creative finance holds immense potential for innovation and growth. As market conditions and regulatory landscapes evolve, we can expect to witness the emergence of novel financial products and services that cater to the evolving needs of businesses and investors.

Impact of Changing Market Conditions

Changing market conditions, such as economic downturns or shifts in industry trends, can significantly impact the creative finance landscape. In response, financial institutions and businesses may adopt more flexible and innovative approaches to financing, exploring alternative sources of capital and structuring deals that mitigate risk and enhance returns.

Creative finance can be an effective way to finance projects or investments. Understanding the different types of creative financing available can help you make informed decisions about your financing options. For example, NPER stands for Net Present Value (NPV), which is a financial calculation used to evaluate the profitability of an investment.

To learn more about NPER, you can refer to this link for a comprehensive explanation. By understanding NPV and other creative financing techniques, you can increase your chances of success in your financial endeavors.

Role of Technology

Technology will continue to play a transformative role in shaping the future of creative finance. Artificial intelligence, blockchain, and other emerging technologies have the potential to automate processes, enhance risk management, and create new investment opportunities. These advancements can streamline operations, reduce costs, and provide investors with greater transparency and access to alternative assets.

Regulatory and Policy Implications

The regulatory landscape surrounding creative finance is constantly evolving. As new financial products and services emerge, regulators may need to adapt existing frameworks or introduce new regulations to ensure market stability and protect investors. Clear and predictable regulatory guidelines can foster innovation while safeguarding the interests of all stakeholders.

Challenges and Opportunities

The future of creative finance presents both challenges and opportunities for businesses operating in the sector. Competition may intensify as new players enter the market, but innovative companies that embrace technology and adapt to changing market conditions can gain a competitive advantage.

Identifying and addressing potential risks, such as regulatory uncertainties or market volatility, will be crucial for long-term success.

Create a table comparing the key features of creative finance and traditional finance.

Creative finance and traditional finance are two distinct approaches to financing that have different advantages and disadvantages. Creative finance involves using innovative financing techniques to obtain funding, while traditional finance relies on more conventional methods.

The following table compares the key features of creative finance and traditional finance:

| Feature | Creative Finance | Traditional Finance |

|---|---|---|

| Definition | Innovative financing techniques used to obtain funding | Conventional financing methods used to obtain funding |

| Advantages |

|

|

| Disadvantages |

|

|

Specific examples of creative financing techniques

There are a number of different creative financing techniques that can be used to obtain funding. Some of the most common techniques include:

- Mezzanine financing

- Venture capital

- Private equity

Mezzanine financing is a type of financing that is secured by the assets of the borrower. It is typically used to finance the acquisition of a business or to provide additional working capital. Venture capital is a type of financing that is provided to early-stage companies with high growth potential.

Private equity is a type of financing that is provided to companies that are not publicly traded.

Design a table comparing different types of creative financing techniques.

Creative financing techniques are financial strategies that go beyond traditional methods to secure funding or manage financial obligations. These techniques can provide innovative solutions for businesses and individuals seeking alternative financing options. Here’s a table comparing different types of creative financing techniques:

| Technique | Description | Advantages | Disadvantages | Examples |

|---|---|---|---|---|

| Revenue-Based Financing | A financing option where lenders provide funding based on a percentage of a company’s future revenue. |

|

|

|

| Asset-Based Lending | A loan secured against a company’s assets, such as inventory, equipment, or real estate. |

|

|

|

| Invoice Factoring | Selling unpaid invoices to a third-party factoring company for immediate cash. |

|

|

|

| Crowdfunding | Raising funds from a large number of individuals through online platforms. |

|

|

|

| Sale-Leaseback | Selling an asset to a third party and then leasing it back, freeing up capital. |

|

|

|

Popular Questions

What are the key benefits of creative financing?

Creative financing offers increased financial flexibility, enhanced growth potential, and access to capital that may not be available through traditional financing channels.

How can startups leverage creative financing?

Startups can utilize creative financing to overcome funding obstacles, accelerate growth, and attract investors who are willing to support innovative ventures.

What are some common types of creative financing techniques?

Common creative financing techniques include mezzanine financing, venture capital, private equity, and asset-backed lending.